Should I Outsource My Chiropractic Billing or Keep It In-House in 2026?

It depends on your practice size, claim volume, and how you want to spend your time.

For most chiropractic and allied health clinics in 2026, outsourcing delivers better financial outcomes with less operational burden.

Here's why the math has shifted.

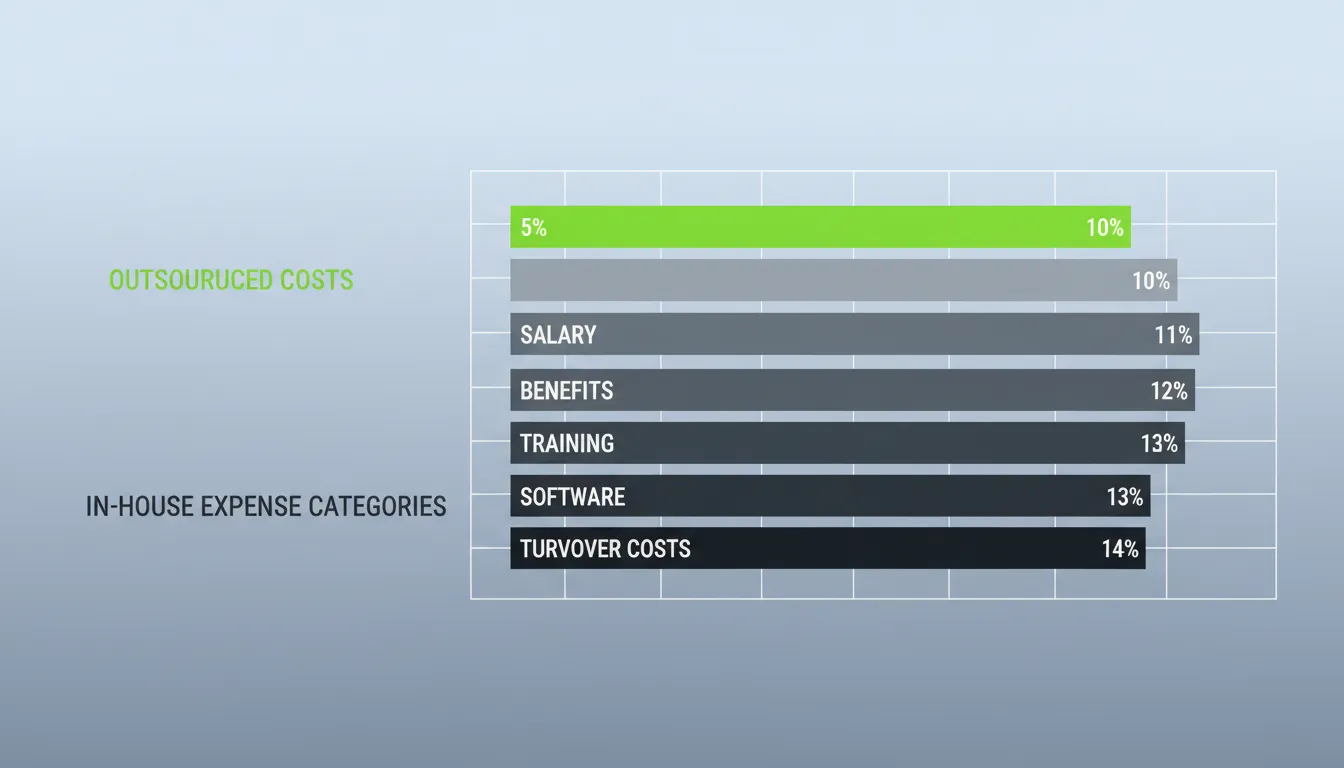

In-house billing typically costs 10-14% of collections. That includes salary, benefits, training, software, and the disruption that comes with staff turnover.

Outsourced medical billing generally runs between 5-10% of collections with no overhead on your end.

That gap represents real money.

But cost is only part of the equation.

The 2026 regulatory landscape is putting pressure on practice margins. Medicare conversion factors for core chiropractic spinal manipulation codes (98940-98942) have faced cuts in recent years. And while Congress passed a temporary 2.5% increase for 2026, efficiency adjustments and practice expense changes continue to compress what practices actually collect.

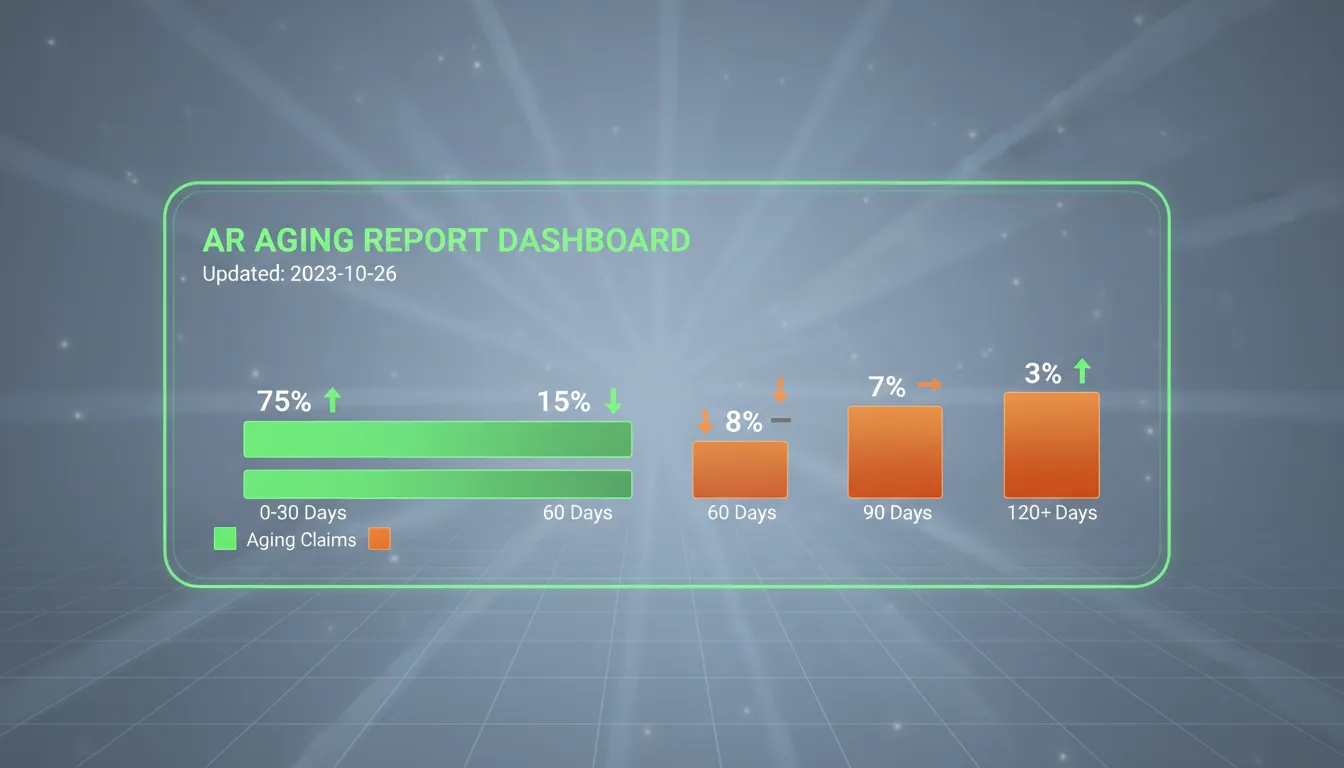

Claims denial rates have been trending upward. Industry benchmarks show denial rates reaching 15% or higher for many practices—revenue that requires time and expertise to recover.

Each denied claim requires someone with the right knowledge to review, correct, and resubmit.

The question worth asking isn't just whether outsourcing costs less.

It's whether your current billing setup gives you the visibility, consistency, and results your practice deserves.

This article breaks down the true costs of both models and how to evaluate whether your practice is ready for a billing partner. We'll also address the legitimate concerns about control and transparency—because those concerns matter.

Understanding the True Cost of In-House Billing

Most clinic owners underestimate what in-house billing actually costs.

The expenses are distributed across multiple budget categories. The salary you pay your biller is just the most visible portion.

When you evaluate this decision, you need to think about maximizing chiropractic revenue through documentation and every cost that affects that outcome.

Salary and Benefits

The average medical biller earns between $45,000 and $55,000 annually, according to Glassdoor and industry salary surveys.

That figure climbs higher for experienced billers with chiropractic-specific expertise.

These are the billers who understand the AT modifier for Medicare. They know how to document medical necessity for maintenance versus active care. They can navigate personal injury liens.

Add employer-paid taxes, health insurance, and retirement matching. The true employment cost runs 25-35% above base salary.

A $50,000 biller actually costs your practice $62,500 to $67,500 annually.

Training and Certification

Billing isn't a static skill set.

ICD-10 codes change annually. Payer policies shift regularly. Medicare documentation requirements evolve.

Your in-house biller needs ongoing training. That means direct costs for courses and certifications, plus time away from processing claims.

The American Academy of Professional Coders reports that certified billers earn 27% more than non-certified billers. Quality expertise commands higher compensation.

Software and Technology

Your EHR subscription is just the starting point.

Many practices also pay for clearinghouse connections, claim scrubbing tools, and eligibility verification services.

These costs range from a few hundred to several thousand dollars monthly, depending on claim volume and the tools you need.

The Cost of Staff Changes

This is the cost clinic owners often don't account for until it happens.

When your biller leaves—and eventually, everyone moves on—you'll need to manage the transition.

Claims may slow down during hiring and training. Denials can accumulate without someone following up.

The typical disruption lasts 4-8 weeks. During that window, cash flow can become unpredictable, and older claims become harder to collect.

When you factor in the total cost of ownership—salary, benefits, software, training, and the revenue impact of turnover—most practices find that in-house billing exceeds the cost of outsourced services.

Calculating Your Actual Cost-to-Collect

Here's a straightforward formula:

Cost-to-Collect = Total RCM Costs ÷ Net Collections

Include everything: biller salary and benefits, software subscriptions, clearinghouse fees, training expenses, and a realistic estimate for transition periods.

Divide by your annual collections.

If that number exceeds 8-10%, you may be paying more for in-house billing than professional services would cost.

What Outsourced Billing Actually Costs

Outsourced medical billing uses several pricing models. Understanding these structures helps you compare options accurately.

Percentage of Collections

This is the most common model.

The billing company charges a percentage of what they actually collect for you. Rates typically range from 5% to 10%, with most chiropractic and physical therapy practices falling somewhere in that range.

This model aligns incentives directly. The billing company benefits when you benefit.

They have good reason to pursue difficult claims, work denials thoroughly, and minimize revenue that might otherwise go uncollected.

Solo practices and lower-volume clinics generally pay toward the higher end (8-10%). Larger practices with more volume can often negotiate rates in the 5-7% range.

Flat Fee Models

Some companies charge a flat monthly fee rather than a percentage.

These typically range from $1,000 to $3,000 per month, depending on practice size and services included.

This model works well for practices that want predictable expenses and have consistent claim volume.

Per-Claim Fees

Some companies charge a flat fee for each claim submitted, typically $4-10 per claim.

This can work well for practices with high claim volume and predictable billing patterns.

One consideration: per-claim fees don't necessarily incentivize the billing company to work denied claims aggressively. They're paid when the claim goes out, not when it gets paid.

What's Actually Included

Pricing only tells part of the story.

A lower percentage rate doesn't help if the company isn't doing the work that protects your revenue.

A thorough systematic approach to denied claims should include eligibility verification, claim submission, denial management, appeals, AR follow-up, and clear reporting.

Some companies charge extra for credentialing, personal injury billing, or ERA/EOB posting. Others bundle everything into a single rate.

Get a detailed breakdown before comparing costs.

The Operational Considerations of In-House Billing

Beyond direct costs, in-house billing involves operational realities worth thinking through carefully.

Most clinic owners don't consider these until they're already navigating them.

The Single-Person Dependency

When one person handles all your billing, you have limited backup.

If that person takes a vacation, gets sick, or moves on, your revenue cycle depends on how well you've prepared.

This happens regularly. A week of missed claim submissions creates a ripple effect that takes time to resolve.

Outsourced billing companies work with teams. When someone is out, the work continues.

That built-in coverage means your revenue cycle keeps moving regardless of any one person's availability.

Expertise and Specialization

Billing chiropractic claims correctly requires specialized knowledge.

General medical billers may not have developed it.

Understanding the chiropractic billing code differences between therapeutic exercises and therapeutic activities can make the difference between clean claims and patterns of denials.

Medicare chiropractic billing adds another layer. The AT modifier. The maintenance versus active care distinction. Documentation requirements for medical necessity.

These aren't intuitive. Getting them wrong costs money.

A billing partner who works with these claims daily stays current on payer-specific requirements.

Technology and Tools

Revenue cycle management technology continues to evolve.

Claim scrubbing algorithms improve. Clearinghouse integrations become more capable. Analytics tools provide better visibility into denial patterns.

Your in-house biller is focused on processing today's claims. They may not have the bandwidth to evaluate and implement better tools.

Billing companies invest in technology because it affects their efficiency and your outcomes. That investment happens without requiring your attention or capital.

Compliance Awareness

Billing errors aren't just lost revenue. They can create compliance concerns.

Incorrect coding, improper modifier use, or inadequate documentation can attract unwanted attention from payers.

Your in-house biller may not be a compliance specialist. They may not recognize when documentation falls short or when certain patterns could raise questions.

Professional billing companies build compliance awareness into their workflows.

The Case for Keeping Billing In-House

Outsourcing isn't right for every practice.

There are good reasons some clinic owners prefer in-house billing. Those reasons deserve thoughtful consideration.

Direct Oversight

With an in-house biller, you maintain direct control over every aspect of your revenue cycle.

You can walk down the hall and ask about a specific claim. You can adjust priorities immediately.

For clinic owners who are deeply involved in their billing operations and value that hands-on relationship, outsourcing can feel like a loss of connection.

Even when reporting and communication are strong.

Institutional Knowledge

A long-tenured in-house biller accumulates knowledge about your specific practice that takes time to develop.

They know your patients. They understand your payer mix. They may have relationships with local insurance representatives.

If you have a skilled, reliable biller who's been with you for years, the value of that relationship is real.

Simpler Operations for Smaller Practices

Small practices with straightforward billing may not need sophisticated RCM support.

If you see primarily cash-pay patients with occasional insurance billing, the complexity that justifies outsourcing may not apply.

If your claim volume is very low, percentage-based fees might exceed what you'd pay a part-time biller.

Making the In-House Model Work Well

If you keep billing in-house, you can strengthen your operation by addressing common vulnerabilities.

Cross-train at least one other staff member on basic billing functions. Invest in ongoing training. Implement clear metrics and run regular AR reports to catch issues early.

Document processes thoroughly so you're not entirely dependent on one person's knowledge.

Have a plan for when your biller eventually moves on.

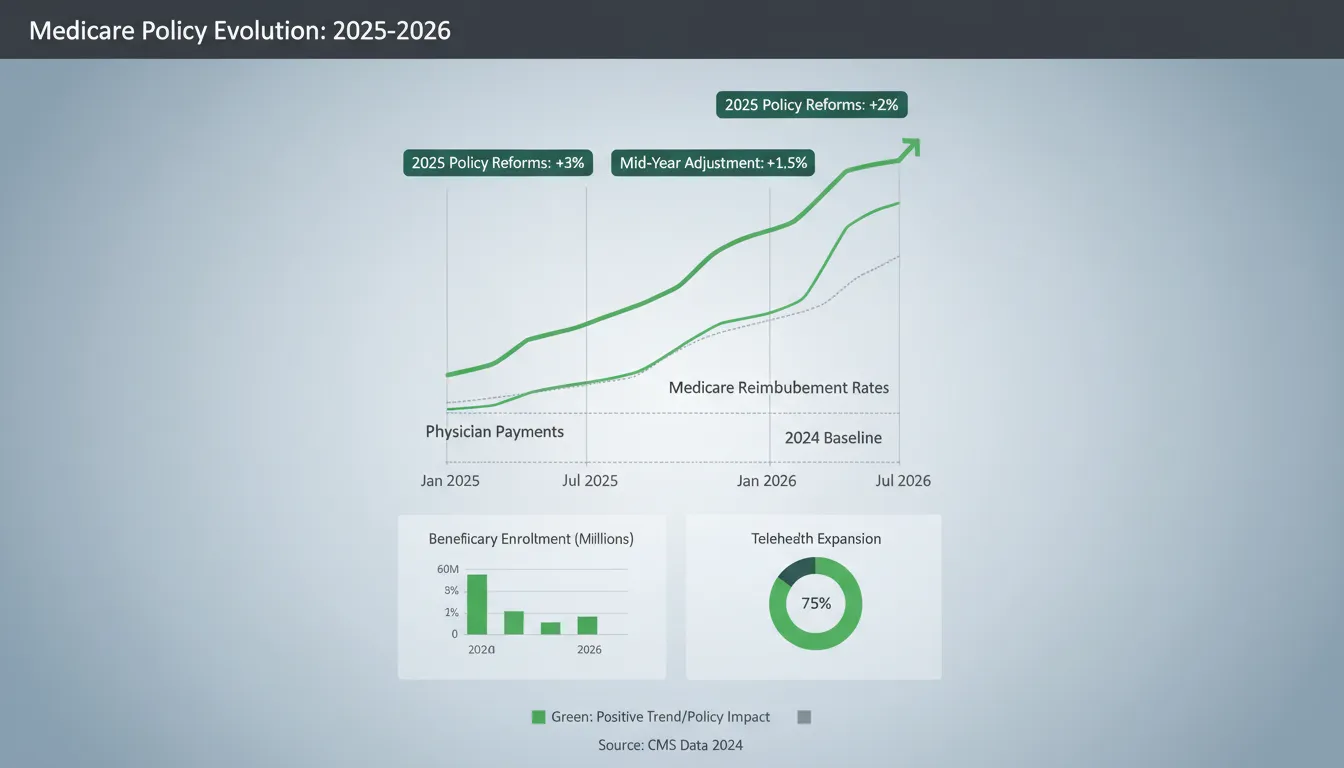

The 2026 Regulatory Landscape

The regulatory environment for 2026 adds context to this decision.

Several factors are affecting how chiropractic and allied health practices think about billing operations.

Medicare Payment Pressure

Medicare reimbursement for chiropractic has faced downward pressure in recent years.

The 2026 Medicare Physician Fee Schedule reflects ongoing changes to conversion factors and practice expense calculations.

While Congress passed a temporary 2.5% increase for 2026, CMS is also implementing efficiency adjustments that affect how services are valued. According to the American Medical Association's analysis, these changes affect different specialties in different ways.

For chiropractic practices billing core spinal manipulation codes (98940, 98941, 98942), the net impact depends on your service mix.

The overall message: margins are tighter than they were five years ago. Billing accuracy matters more.

Denial Rate Trends

Claim denials have been trending upward across most payer types.

Industry benchmarks show denial rates reaching 15% or higher for many practices. Commercial payer and Medicare Advantage denials have been particularly active areas.

Payers are using more sophisticated systems to review claims. These systems catch more issues, which means more claims need attention after initial submission.

Preventing denials through accurate initial submission is always more efficient than recovering from them afterward.

Documentation Standards

Payers continue refining documentation expectations, particularly around medical necessity.

ICD-10 updates effective late 2025 require greater specificity for many common conditions.

The space between what your clinical notes contain and what payers need for clean adjudication is important to understand.

Closing that gap requires either improving documentation on the clinical side or having billing support that identifies issues before claims go out.

What This Means for Your Decision

These trends raise the bar for billing operations.

Tighter margins. More denials. More documentation scrutiny.

They don't automatically mean outsourcing is right for you.

But they do mean whoever handles your billing needs the expertise, systems, and focus to navigate an environment that demands more precision than it did five years ago.

Evaluating Your Current Billing Performance

Before making any changes, understand how your current billing operation actually performs.

Many clinic owners have a general sense but haven't looked closely at the specific numbers.

Key Performance Indicators

These metrics give you a clear picture:

- Denial Rate - Percentage of claims initially denied. A healthy target is under 5%. Consistently above 10% is worth investigating.

- Days in AR - How long claims remain unpaid on average. Most practices aim for 30-40 days. Above 50 suggests collection may be slower than it could be.

- Clean Claim Rate - Percentage of claims accepted on first submission. Strong performance means 95% or higher.

- Collection Rate - Actual collections as a percentage of expected reimbursement. For contracted payers, this should be 95% or better.

- AR Over 90 Days - Percentage of outstanding receivables beyond 90 days. Should be under 15% of total AR.

If you can't readily access these numbers, that tells you something about the visibility your current operation provides.

Signs That May Indicate Room for Improvement

Beyond raw metrics, consider these observations.

Your biller has difficulty explaining why specific claims were denied. Cash flow fluctuates in ways that don't connect to patient volume.

Your AR aging report shows claims sitting unworked for extended periods. Patients mention confusion about their bills.

Your biller seems uncomfortable when you ask questions about performance.

The Value of a Fresh Perspective

Consider having someone outside your day-to-day operations review your billing.

Fresh eyes often notice issues that become invisible when you're too close.

Look specifically at what happens after claims are denied. Are they being worked systematically? Are patterns being identified and addressed?

Understanding common denial codes and what they reveal about your billing operation helps inform your decision.

What to Look for in a Billing Partner

If you decide outsourcing is the right direction, choosing the right partner matters.

Not all billing companies operate the same way. The fit between your practice and your partner affects results.

Specialty Experience

General medical billing companies may not have deep experience with chiropractic-specific requirements.

The AT modifier. Maintenance versus active care documentation. Personal injury liens. Medicare compliance.

These all benefit from specialized knowledge.

Ask prospective partners about their chiropractic and allied health experience. How many similar practices do they serve? Can they discuss common challenges in your field with confidence?

A partner who understands your world will recognize issues you might not notice.

Platform Compatibility

Your billing partner should work within your existing EHR.

Whether that's Jane App, ChiroTouch, or another platform, look for companies that don't require you to switch software.

Platform-agnostic billing partners integrate directly with your workflow. They become proficient users of your existing system.

When you're switching EHR software, a billing partner with experience across multiple platforms can help smooth that transition.

Communication and Transparency

This is where many billing relationships succeed or struggle.

The right partner provides clear, regular communication about your billing status. Not just when you ask, but proactively.

Expect weekly or monthly reporting with key metrics. Expect responsiveness when you have questions. Expect your partner to surface issues before they become significant.

If a billing company is vague about communication or dismissive of your desire for visibility, pay attention.

The Revenue Guardian Approach

Some billing partners position themselves as protectors of your revenue rather than processors of your claims.

This mindset difference shows up in how they work.

A transactional billing company submits claims and processes payments.

A partner with a Revenue Guardian perspective actively monitors your revenue cycle. They identify opportunities. They advocate with payers on your behalf. They treat your financial health as their responsibility.

The difference appears in how they describe their role and structure their services.

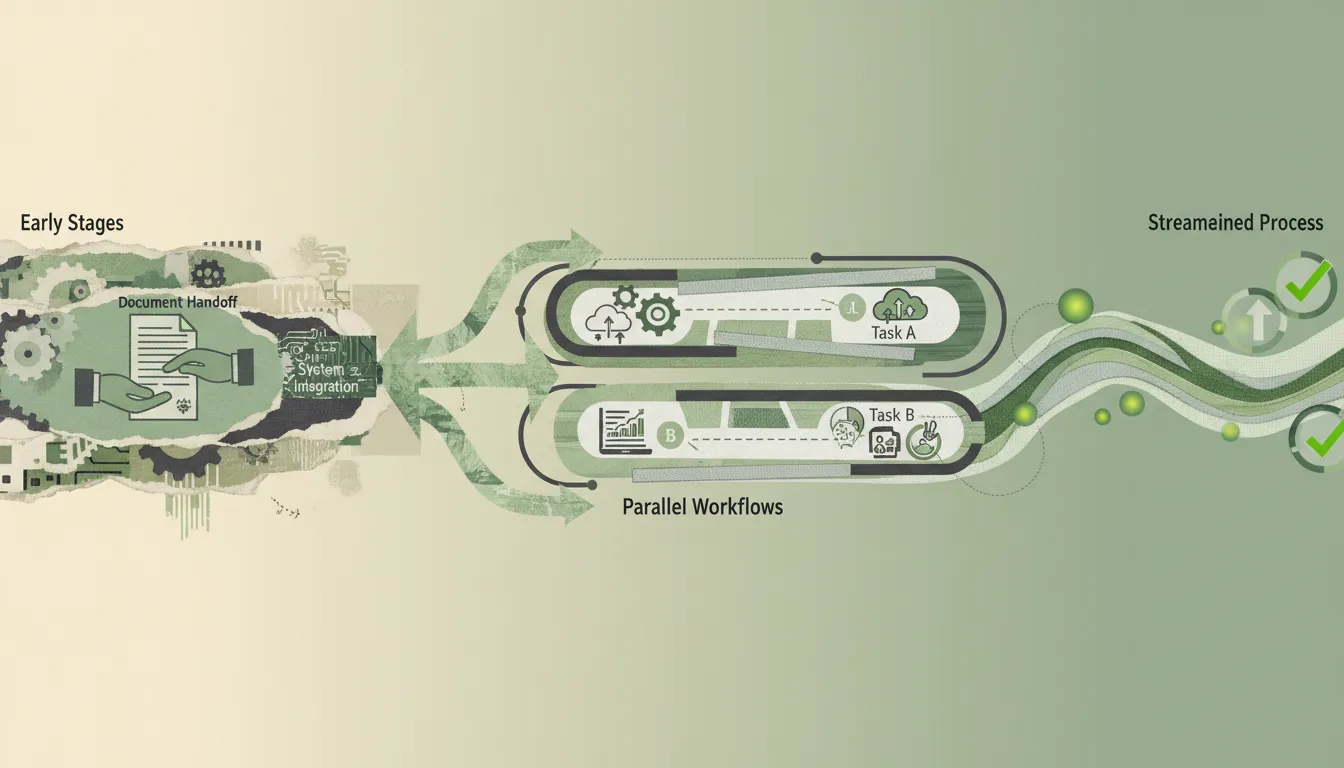

Making the Transition: What to Expect

Switching from in-house to outsourced billing—or changing medical billing partners—involves a transition period.

Realistic expectations help.

The Onboarding Process

Well-organized billing partners have structured onboarding.

This typically includes system access setup, review of existing AR, documentation of your preferences and workflows, and clarification of how you'll communicate.

The phase usually takes 2-4 weeks for full implementation. Claim submission can often begin within the first few days.

Expect your new partner to ask many questions. They're building the understanding needed to represent your practice accurately.

Managing the Overlap Period

Most transitions involve a period where previous processes wind down while new processes ramp up.

This requires coordination.

If you're moving from an in-house biller, have them document processes and provide context on outstanding claims. If switching from another billing company, ensure clean handoff of AR and claim history.

The goal is continuity. Claims submitted before the transition need tracking. AR your new partner inherits needs systematic attention.

Setting Realistic Expectations

Don't expect perfection from day one.

Your new billing partner needs time to learn your patterns, understand your payer mix, and optimize their approach.

What you should expect: clear communication about progress, visible improvements in organization, and responsiveness when you raise concerns.

By month three, you should see measurable movement in key metrics. By month six, the relationship should feel like a genuine partnership.

Frequently Asked Questions

Is it cheaper to have an in-house biller or use a billing service?

For most chiropractic and allied health practices, outsourcing tends to be more cost-effective.

In-house billing typically costs 10-14% of collections when you factor in salary, benefits, training, software, and transition costs. Outsourced billing generally runs 5-10% with no overhead.

The break-even point depends on your claim volume and practice size.

Solo practices with minimal insurance billing may find in-house more economical. Multi-provider practices usually benefit from outsourcing.

What is the average commission rate for chiropractic billing companies?

Most charge between 5% and 10% of collections.

Solo practices typically pay toward the higher end (8-10%). Larger practices with more volume may negotiate rates in the 5-7% range.

Some companies also offer flat monthly fees ($1,000-$3,000) or per-claim pricing.

How do I know if my in-house biller is doing a good job?

Track key metrics: denial rate under 5%, days in AR under 35, clean claim rate above 95%, collection rate of 95%+.

Run regular AR aging reports to identify claims at 60+ days.

Ask your biller to explain denial patterns and what's being done to address them. If they can't speak to these metrics clearly, that's worth exploring.

What happens to my billing if my office manager quits?

Claims may slow down. Denials can accumulate during the transition.

Most practices experience 4-8 weeks of disruption while hiring and training a replacement.

Outsourced billing provides built-in redundancy. Teams continue working regardless of individual personnel changes.

Do I lose control of my finances if I outsource my billing?

Not with the right partner.

Quality billing companies provide transparent reporting, access to your billing data, and clear communication about claims status.

Many practice owners actually gain better visibility because professional billers track metrics that in-house staff sometimes don't monitor systematically.

Can a billing company work within my existing Jane App or ChiroTouch?

Yes.

Platform-agnostic billing companies integrate directly with your existing EHR. They work within your software rather than requiring you to switch.

No disruption to your clinical workflow. No software migration.

Look for partners who can speak specifically to their experience with your platform.

How do the 2026 Medicare changes affect my billing strategy?

Medicare reimbursement for chiropractic has faced downward pressure, with conversion factor changes affecting core spinal manipulation codes.

While Congress passed a temporary 2.5% increase for 2026, efficiency adjustments continue to compress margins.

This makes billing accuracy and denial prevention more important. Understanding insurance verification processes and ensuring clean claims helps protect your revenue.

What is the Revenue Guardian model of medical billing?

It positions a billing partner as a proactive protector of your revenue rather than simply a claims processor.

This approach emphasizes denial prevention over denial management, systematic AR monitoring, documentation support, and advocacy with payers.

It treats billing as a strategic function rather than a purely administrative one.

Making Your Decision

The outsourcing versus in-house question doesn't have a universal answer.

But there's a clear framework for finding the right answer for your practice.

Outsourcing may make sense if your billing costs exceed 8% of collections, you're concerned about staff continuity, denial rates are climbing, you don't have strong visibility into your metrics, or navigating 2026 regulatory changes feels overwhelming.

Staying in-house may make sense if you have a long-tenured, high-performing biller, your practice is small with straightforward billing, direct control is more valuable to you than cost optimization, or you're prepared to invest in training, technology, and backup coverage.

For most chiropractic and allied health practices navigating 2026, the case for partnering with billing specialists has strengthened.

The economics tend to favor it. The operational benefits are meaningful. The consistency improves over time.

But this decision isn't purely about cost.

It's about whether your billing operation is set up to perform reliably in an environment that keeps getting more complex.

It's about whether you want to invest your energy in billing management or in patient care and practice growth.

Whatever direction you choose, make the decision thoughtfully.

Evaluate your current performance honestly. Understand the true costs. And if you choose a billing partner, find one who takes your financial health as seriously as you do.

Making the decision to change how you handle billing is a meaningful step.

After working through all of this, you might be wondering where to start.

If you're thinking "this makes sense, but I don't have time to sort it all out," you're not alone. Most clinic owners we work with felt the same way before they got clarity on what was actually happening with their revenue.

That's why we offer a free discovery call.

It's a chance to talk through your current billing situation. Understand what's working. See what could be better. Look at your options.

We can help you understand:

- Where your claims might be getting held up

- What's behind your denials or payment delays

- Whether your AR is healthy or needs attention

- How your current process compares to what we typically see

- What working with Bushido would actually involve

Book a Call — no pressure, no obligation, just a straightforward conversation about your billing.

Because the sooner you have clarity, the sooner you can focus on what you actually went into practice to do.

SCHEDULE YOUR FREE DISCOVERY SESSION TODAY.

Copyright 2026 | All rights reserved | Web Design by iTech Valet